Workers feel sting from shift to high-deductible health coverage

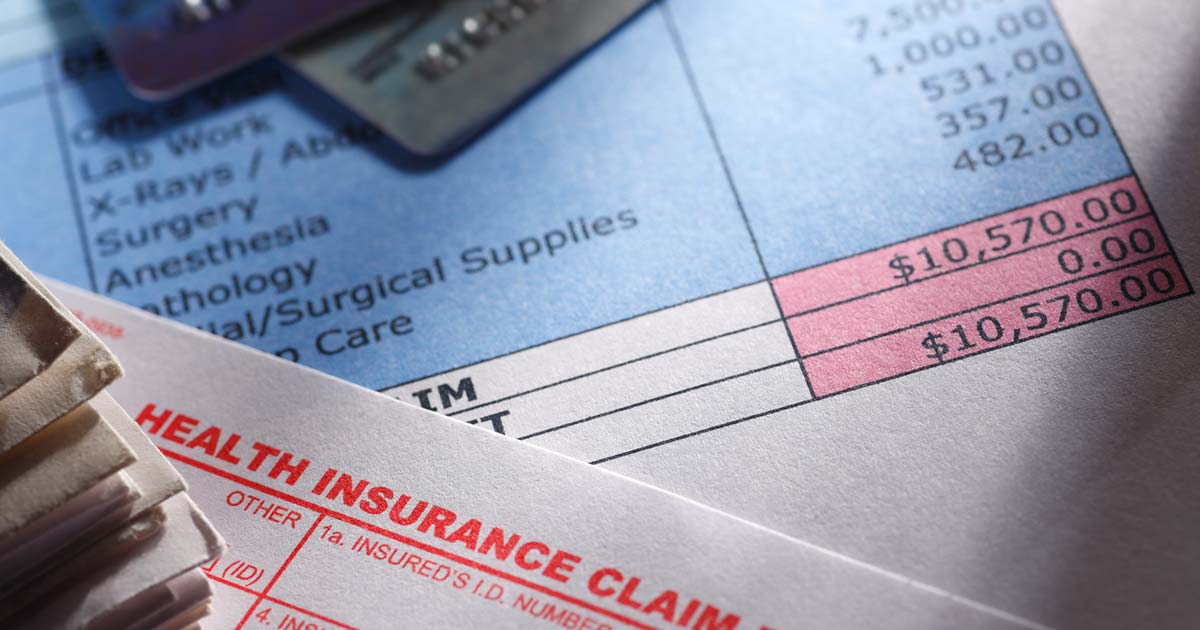

Nearly half of Americans with private insurance—47%—are covered by high-deductible plans, up from 25% in 2010. That’s driven up out-of-pocket health spending among people with employer coverage—from $493 in 2007 to $792 in 2017.

Johnson & Dugan Insurance Services Corporation

Lacey Robinson's Instagram, Twitter & Facebook on IDCrawl

BenefitsPRO: Employee Benefits News, Trends & Sales Tips

Healthcare costs are too expensive for employees, EBA

The Value of Fringe Benefits

COVID-19 Exposed the Fragility of Job-Connected Health Insurance For People and Employers – United States of Care

Section 7: Employee Cost Sharing - 10240

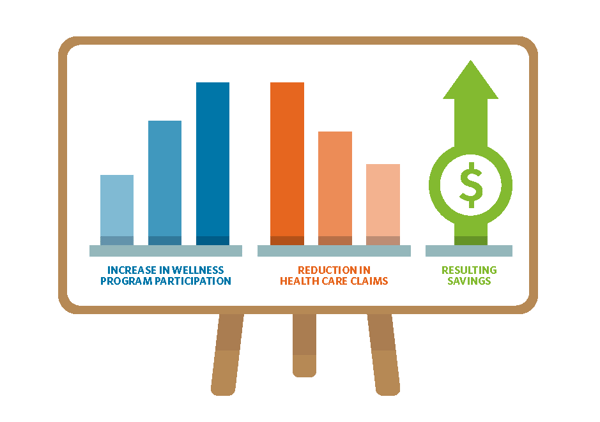

Our approach

SEPT. 20-26, 2019 – Indianapolis Business Journal

As health care costs rise, workers at low-wage firms may pay a larger share

Section 7: Employee Cost Sharing - 10020

Section 7: Employee Cost Sharing - 10240

New UCHealth price estimator helps patients navigate health care system – Longmont Times-Call

Everyone seems to reccomend the HSA for medical insurance but from what I'm seeing, the PWA is much better based on the deductible. What am I missing this is my first time