Fund overlap: the hidden risk in your portfolio

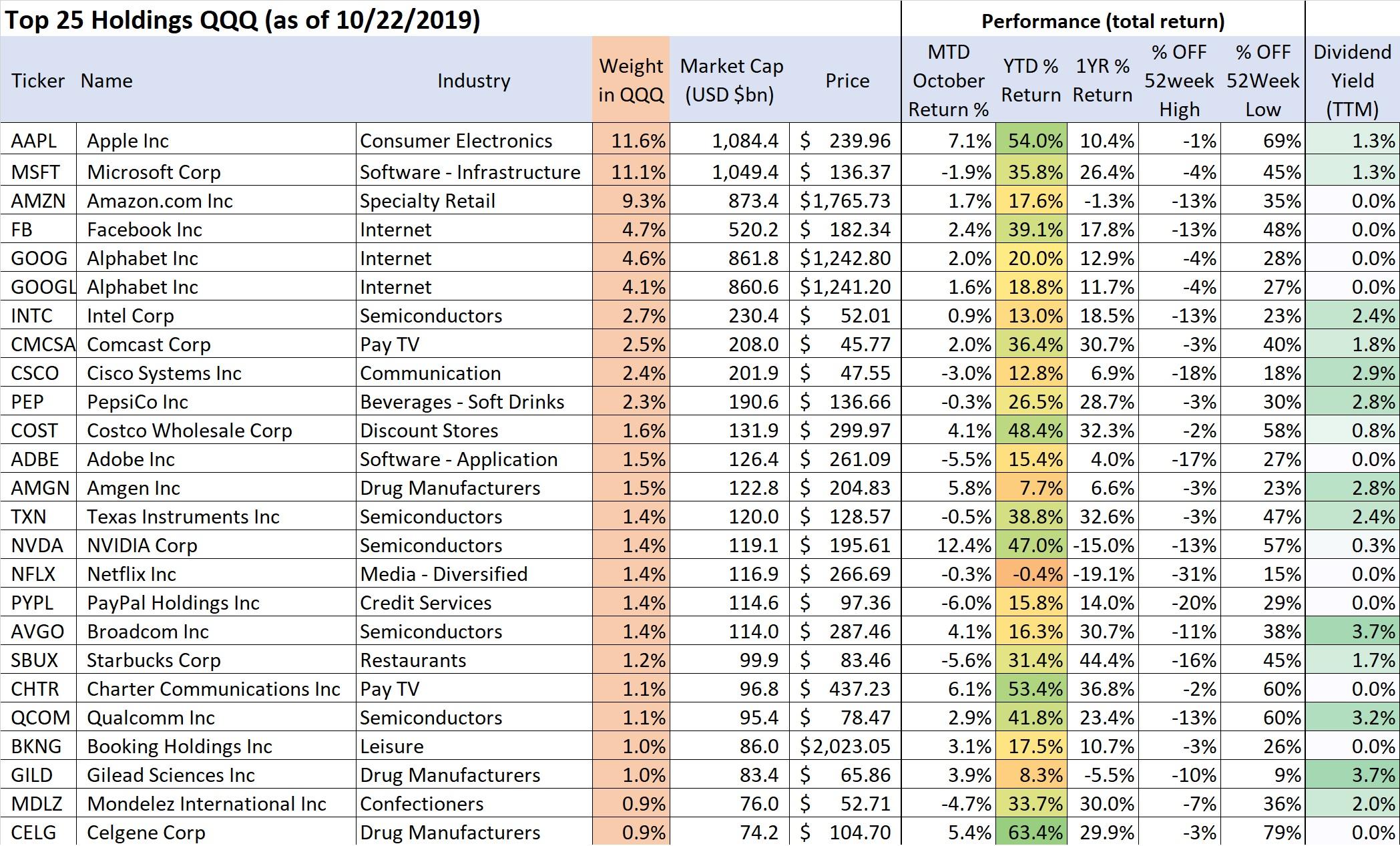

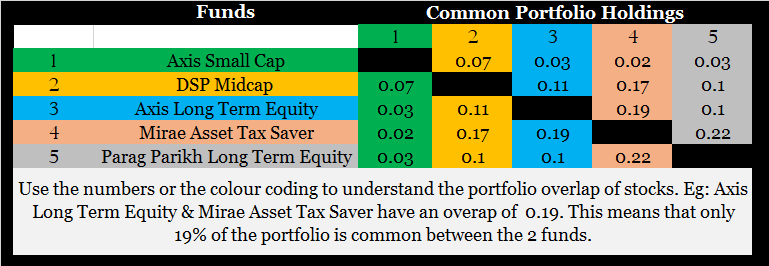

Fund overlap is a hidden risk in your portfolio. You may own different funds, but if those funds all own the same stocks then you're not diversified.

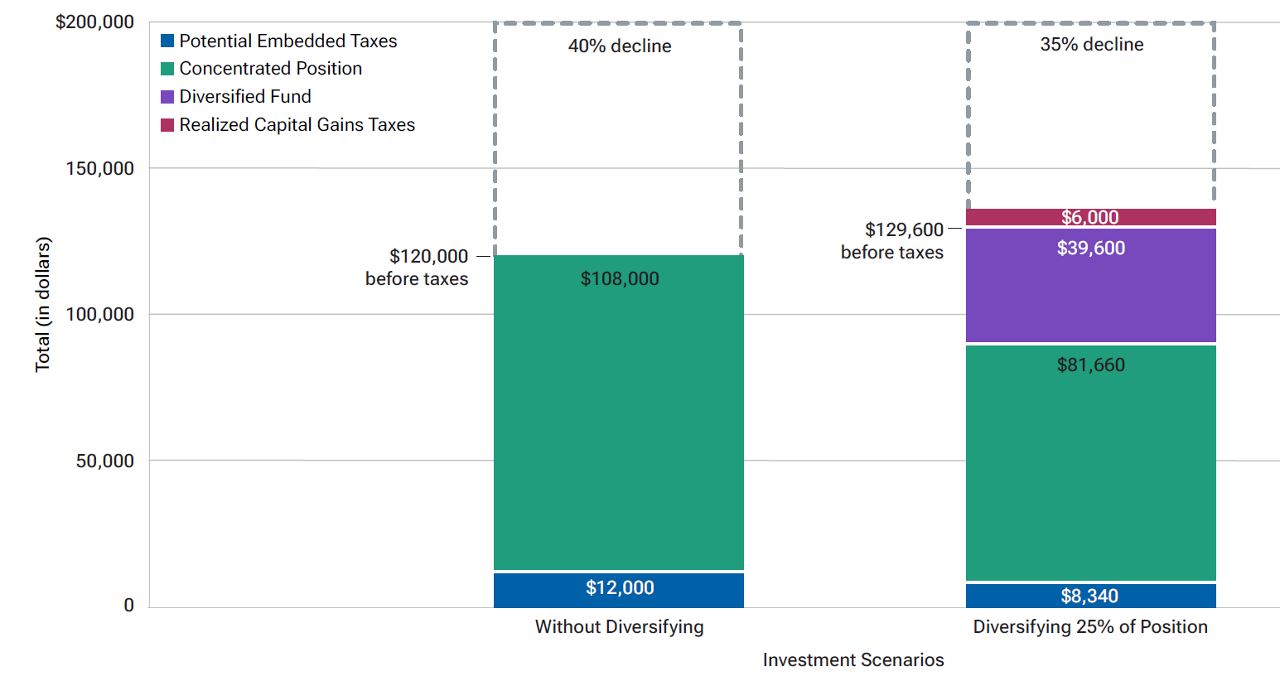

Concentrate on Concentration Risk

Understanding Private Equity Fund Accounting

What is a Hedge Fund & How Hedge Funds Work

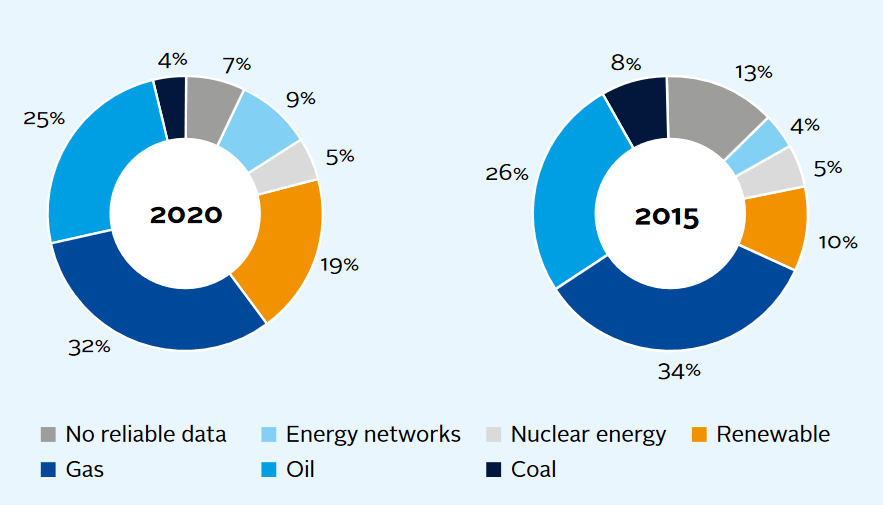

An introduction to responsible investment: climate metrics, Introductory guide

How to Measure Hedge Fund Overlap and Why it Matters

Fund Overlap Risk: Minimizing Redundancy in Investment Portfolios - FasterCapital

The Hidden Dangers Of Passive Investing

Fund overlap: the hidden risk in your portfolio

Helpful Actions You Can Take if Your Portfolio Is Too Concentrated in One Equity

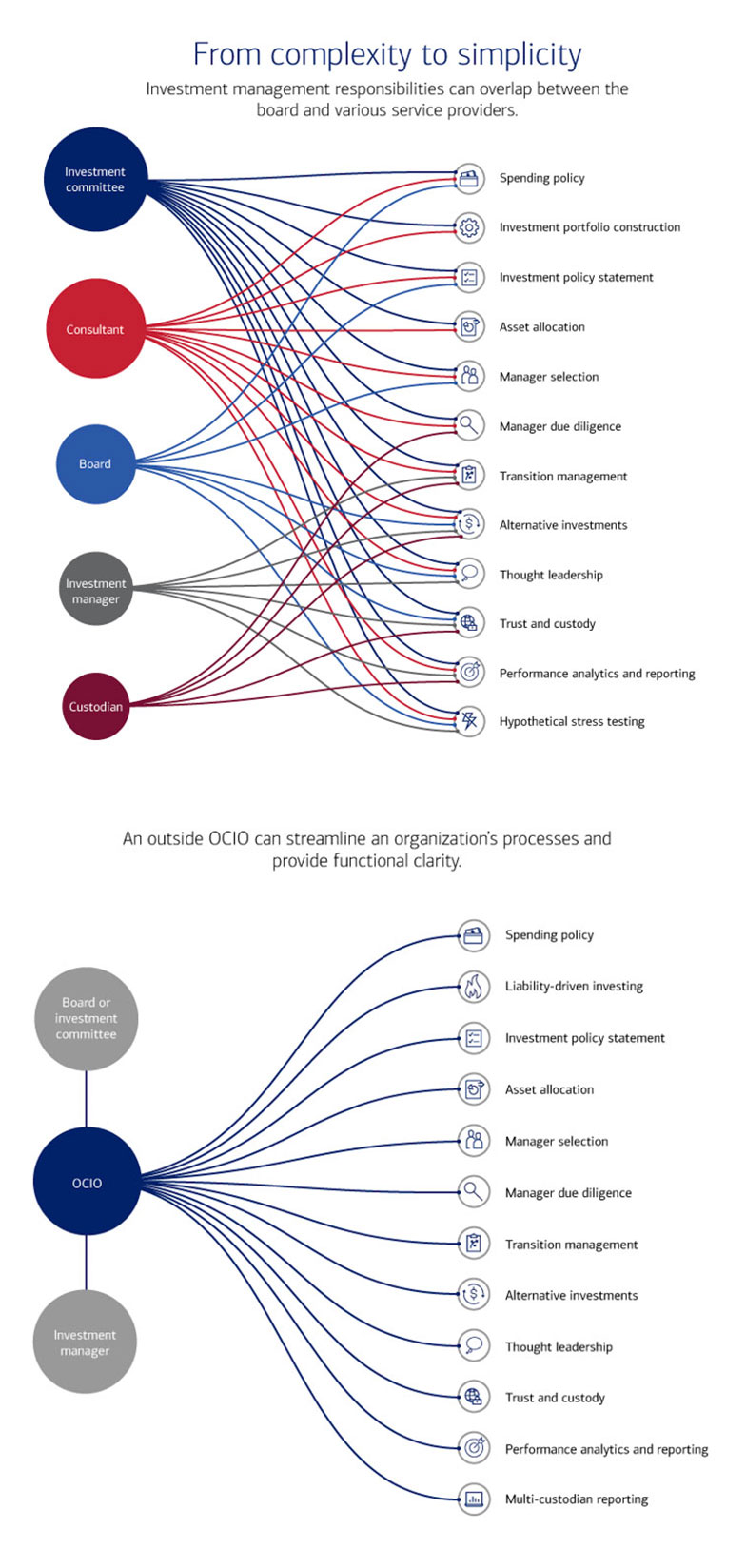

Should Your Nonprofit Use an Outsourced CIO (OCIO)?

:max_bytes(150000):strip_icc()/how-do-mutual-funds-make-money-5951e30f5f9b58f0fc8641a2.jpg)

How Many Mutual Funds Do You Need to Build a Portfolio?

:max_bytes(150000):strip_icc()/diversification.asp-FINAL-b2f2cb15557b4223a653c1389389bc92.png)

What Is Diversification? Definition as Investing Strategy

Minimizing Risk, Maximizing Returns: A Stock Portfolio Guide

How Private Equity Works: A Brief Explainer

What is the stock overlap in your portfolio?, Articles