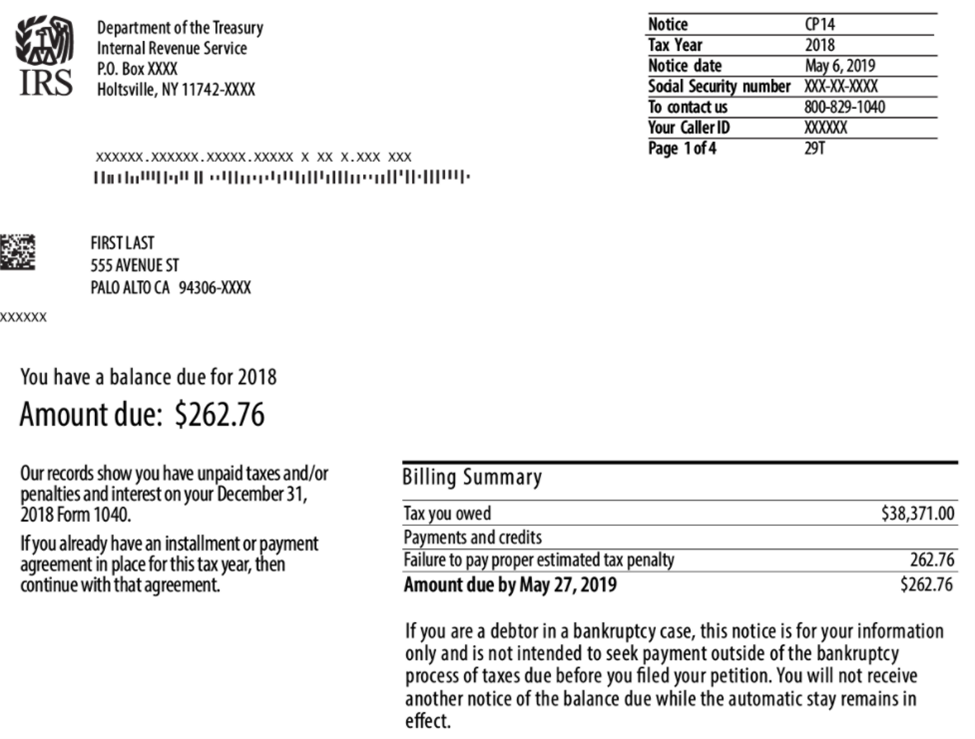

What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

By A Mystery Man Writer

Got a threatening letter, intent to seize your assets, don't panic, help is on the

Online account frequently asked questions

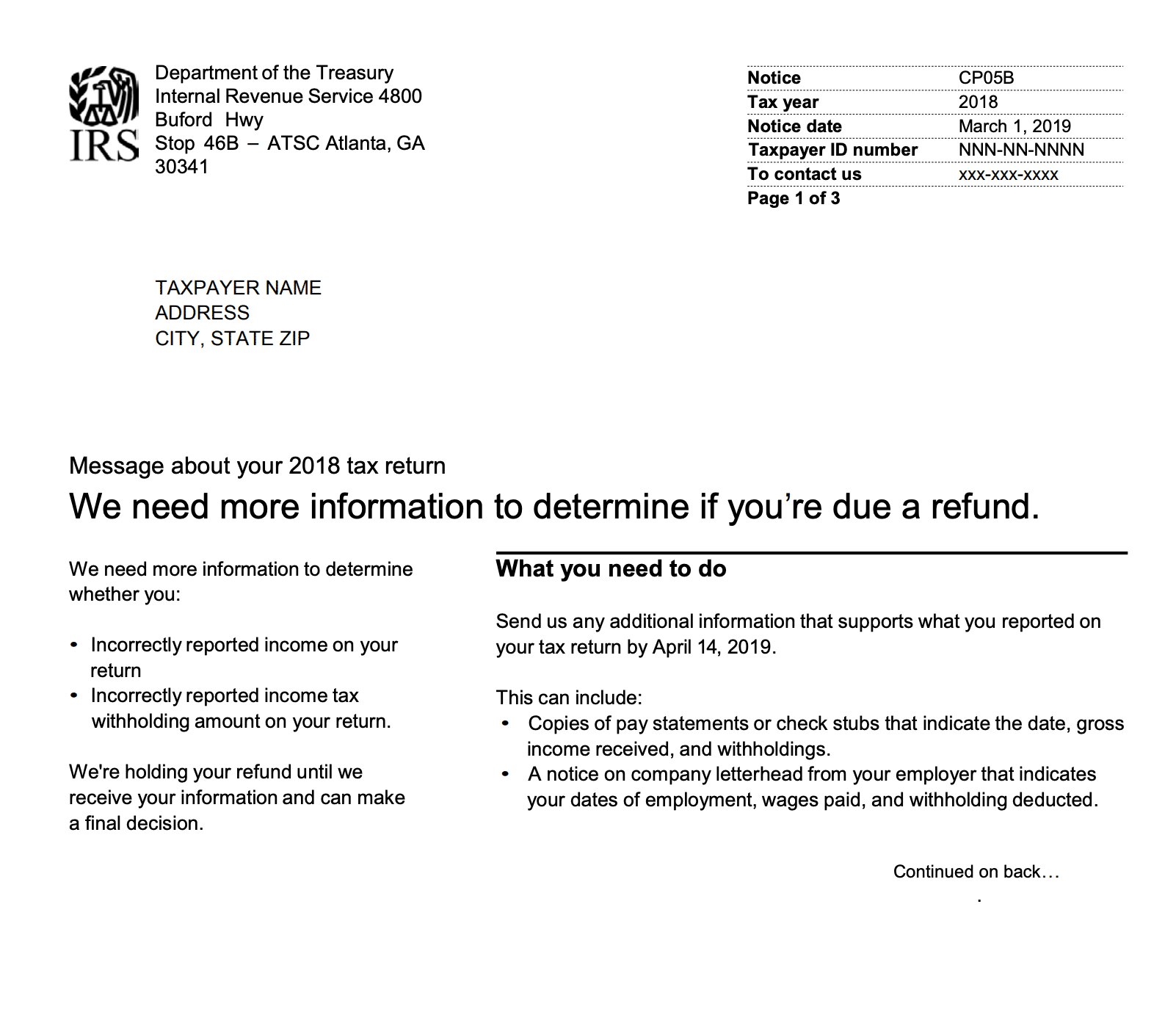

What Is a CP05 Letter from the IRS and What Should I Do?

What Is a CP05 Letter from the IRS and What Should I Do?

I need help resolving a tax amount owed or finding the right payment option? - TAS

IRS Letter 4464C: Help! Am I Being Audited?

Notice CP40: The IRS Has Assigned You to a Debt Collector

How Long Do You Really Have To Respond to an IRS Tax Due Notice? - The Wolf Group

IRS Letter 3219: What To Do When the IRS Sends You a Notice of Deficiency - Choice Tax Relief

Tax Audits and Notices

IRS Notice CP523: What To Do When the IRS Threatens to Terminate Your IA - Choice Tax Relief

:format(webp)/https://static-hk.zacdn.com/p/hollister-3680-5854636-1.jpg)