Tie breaker Rule for an individual in International Taxation

By A Mystery Man Writer

Article 4 deals with the provision, where an individual becomes a tax resident of the Country of Source as well as Country of Residence . I.

Guide to the US France Tax Treaty

CA Arinjay Jain on LinkedIn: #internationaltax #tax #taxes

CA Arinjay Jain on LinkedIn: #uaecorporatetax

CA Arinjay Jain on LinkedIn: #internationaltax #internationaltax

IRS Taxation and U.S. Expats - ppt download

U.S. Australia Tax Treaty (Guidelines)

A Guide to International Taxes when Working Remotely

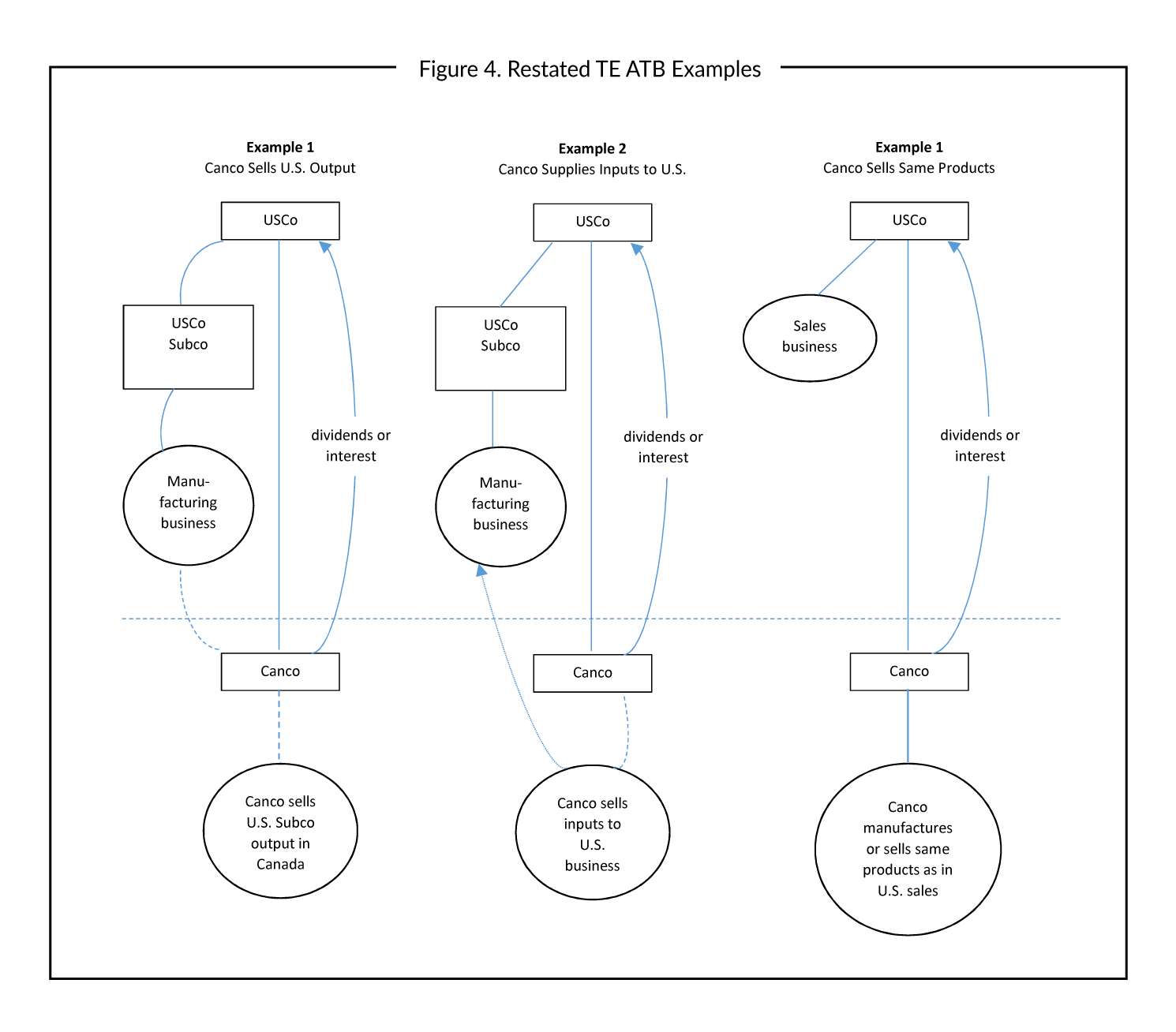

Chapter 8 Are Tax Treaties Worth It for Developing Economies? in: Corporate Income Taxes under Pressure

Acquiring Business in India - Acquisition of shares Vs

Tax Treaties Business Tax Canada