What Happens When You Don't File a 1099? - TurboTax Tax Tips & Videos

Learn about what happens if you forget to file a 1099. See how to fix mistakes, amend your return, and avoid potential issues with the IRS.

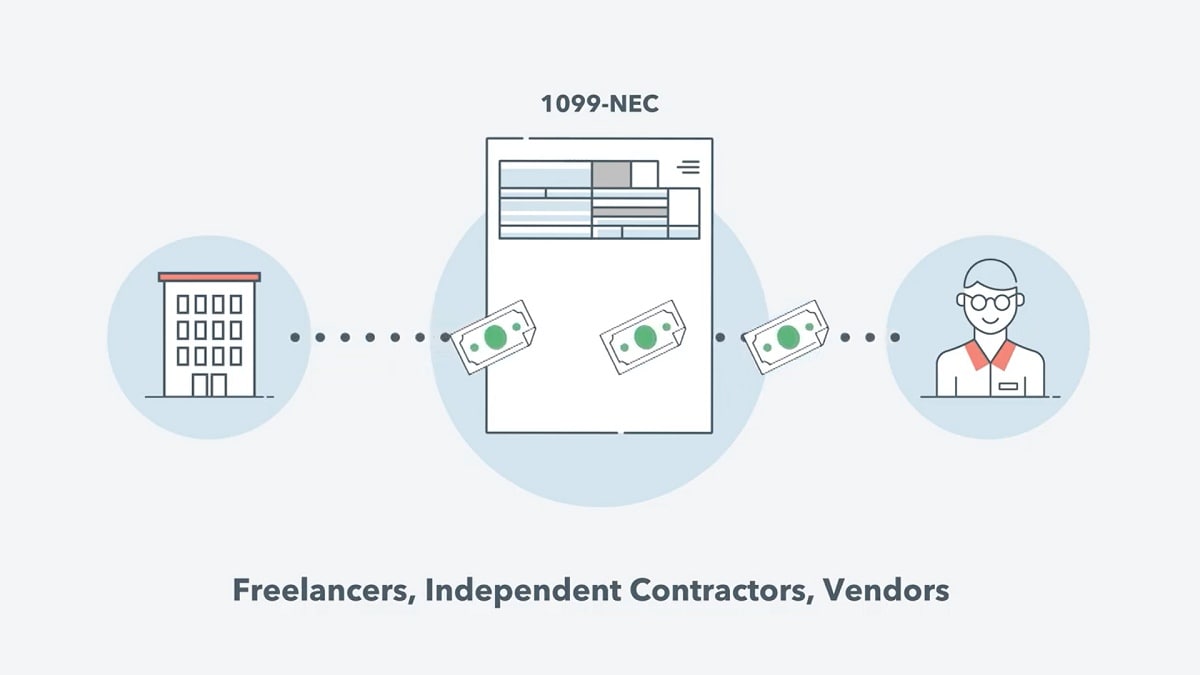

What is the Form 1099-NEC? - Intuit TurboTax Blog

Calculating Taxes on IRS Form 1099 Misc - TurboTax Tax Tip Video

TurboTax 2022 Form 1040 - Enter Form 1099-DIV for Dividend Income

How to File Taxes Online in 3 Simple Steps - TurboTax Tax Tip Video

What to Do If You Don't Receive Your Form 1099 by January 31st

What Is the IRS Form 1099-MISC? - TurboTax Tax Tips & Videos

Video: 1099-MISC and 1099-NEC: What's the Difference? - TurboTax Tax Tips & Videos

Deductions for Sales Tax - TurboTax Tax Tips & Videos

The Art of Keeping Receipts for Your Taxes - TurboTax Tax Tips & Videos

Video: NFT Tax Tips for Investors and Creators - TurboTax Tax Tips & Videos

Need More Time? File a Tax Extension - TurboTax Tax Tips & Videos

/cdn.vox-cdn.com/uploads/chorus_image/image/72111659/Screen_Shot_2022_07_12_at_10.55.30_AM.0.png)