Hanesbrands: Reducing Inventory Is The Key To A Turnaround (NYSE

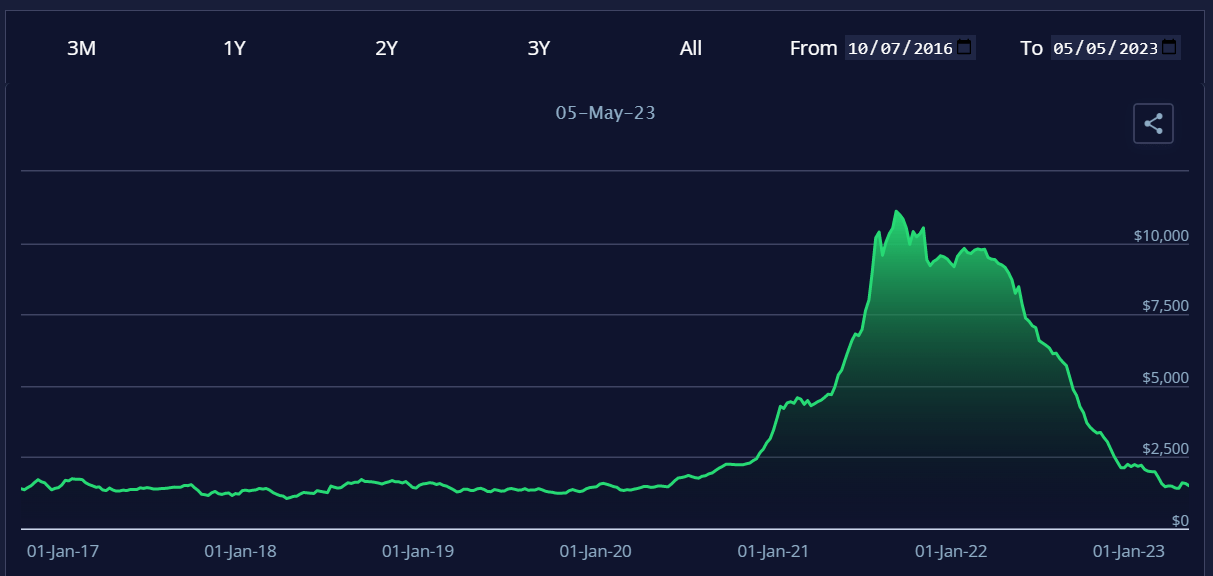

Hanesbrands' priority is to reduce inventory which will help its gross margins and debt issues. Click here to see why HBI stock is a Buy.

Hanesbrands' priority is to reduce inventory which will help its gross margins and debt issues. Click here to see why HBI stock is a Buy.

Hanesbrands: Temporary Headwinds, Long-Term Value (NYSE:HBI)

Hanesbrands: I See Deep Value In Recession Resistant Apparel (NYSE:HBI)

V.F. Corp. And Hanesbrands - Debt Vs. Dividends (NYSE:HBI)

Should Value Investors Pick Hanesbrands (HBI) Stock Now?

Hanesbrands Inc. (NYSE:HBI) to Post Q1 2024 Earnings of ($0.06) Per Share, Zacks Research Forecasts - Defense World

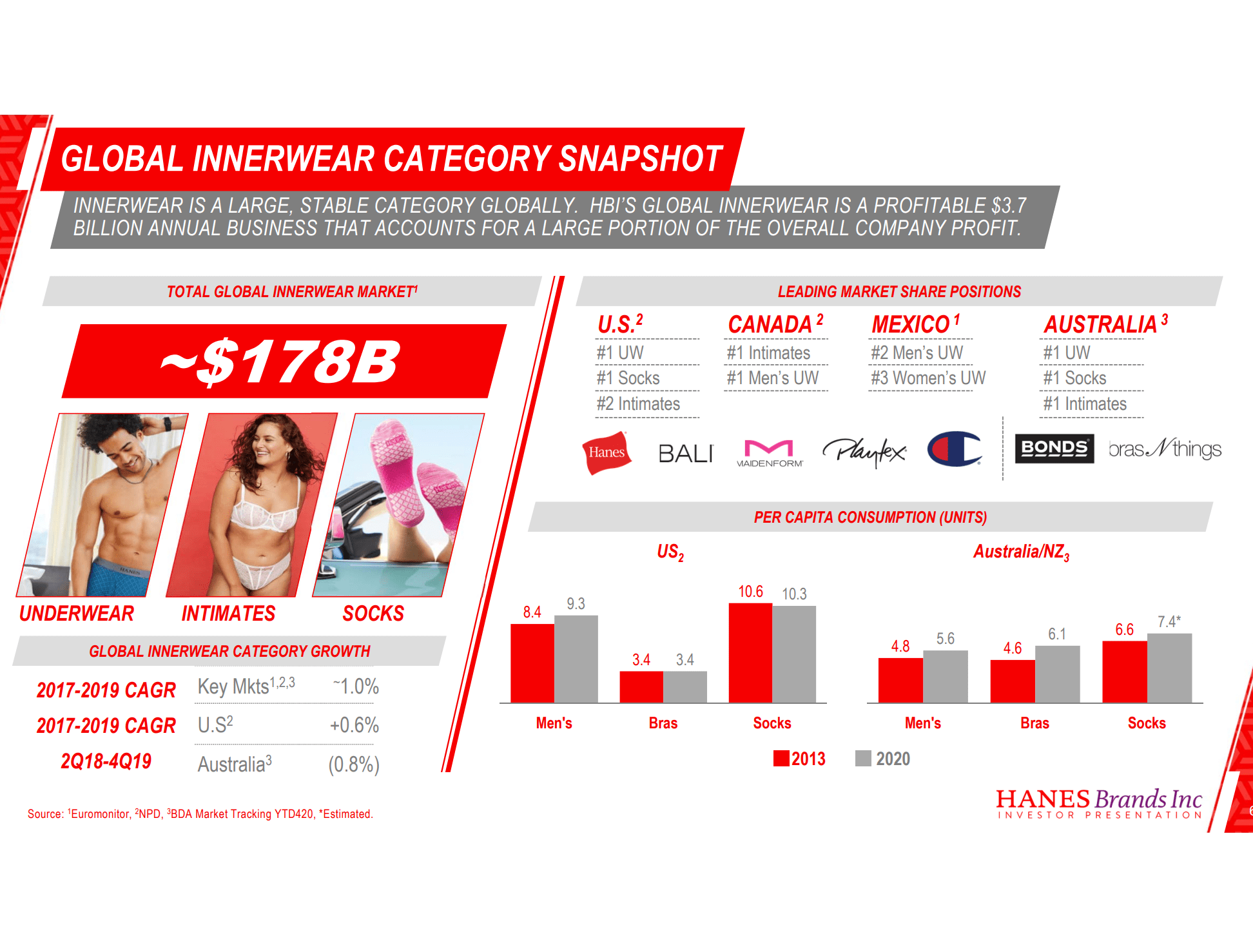

Hanesbrands: Speculative Buy On Innerwear Business Turnaround

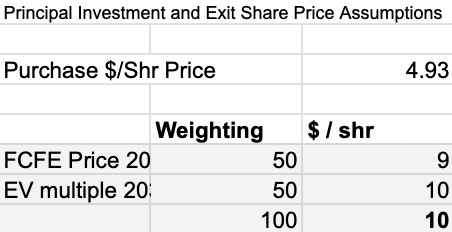

Our new investment idea: Hanesbrands Inc (NYSE: HBI)

Hanesbrands: Speculative Buy On Innerwear Business Turnaround

Hanesbrands Offers Good Risk/Reward Opportunity For Patient Investors (NYSE:HBI)

Early-Stage Stock Investing - Cabot Wealth Network

Hanesbrands: Turnaround Opportunity For This Extremely Undervalued Stock ( NYSE:HBI)