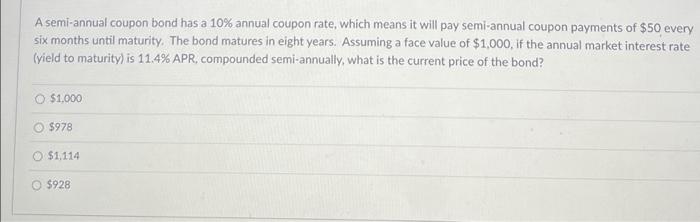

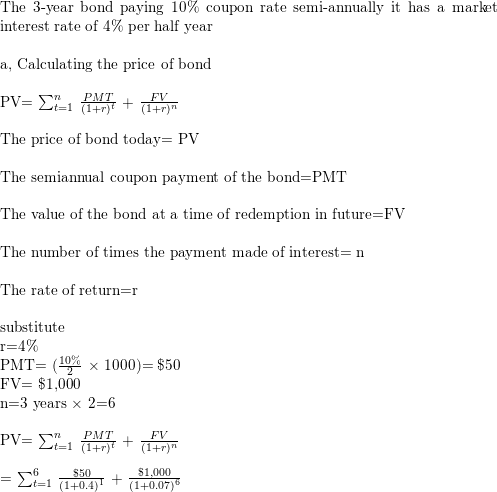

Solved A semi-annual coupon bond has a 10% annual coupon

Answered: Example: Suppose that a bond has a face…

Calculate the YTM of a Coupon Bond

Bond Valuation - Wize University Introduction to Finance Textbook

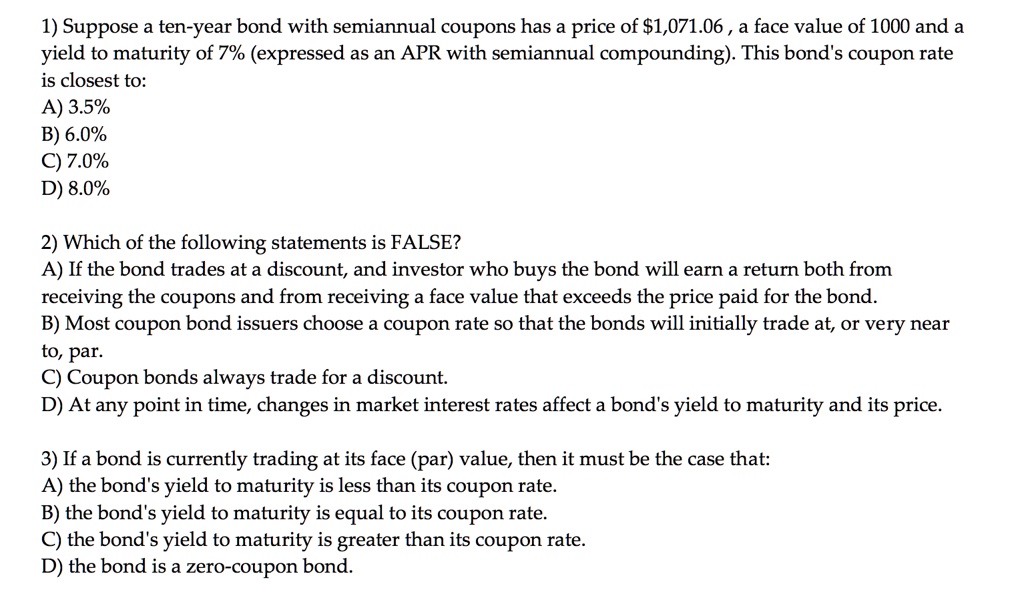

SOLVED: 1) Suppose a ten-year bond with semiannual coupons has a price of 1,071.06 , a face value of 1000 and a yield to maturity of 7% (expressed as an APR with

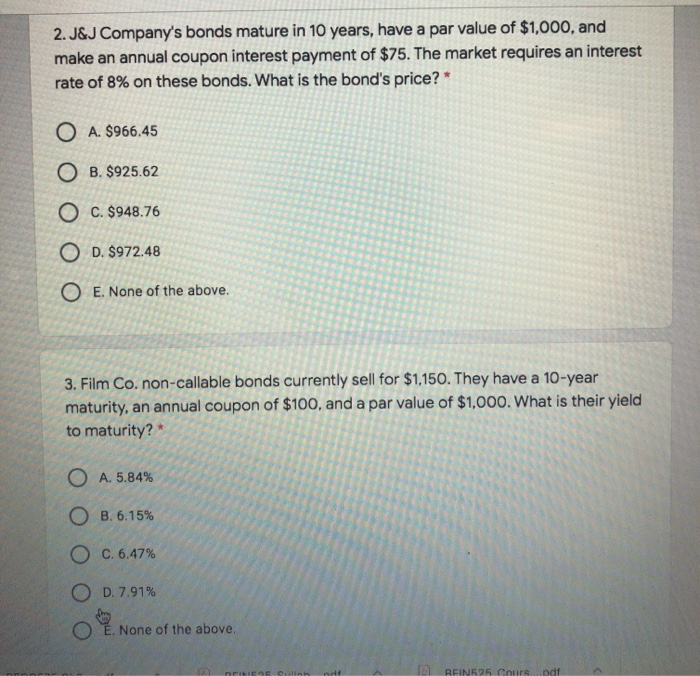

Solved Choose the correct answer 1. A Treasury bond has a

Consider a bond paying a coupon rate of 10 % per year semian

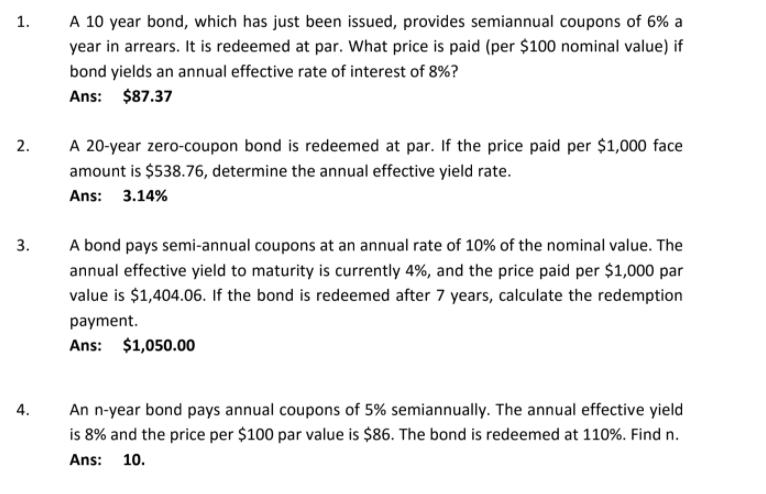

Solved 1. A 10 year bond, which has just been issued

Modified Duration - Zero Coupon Bond Modified Duration Formula

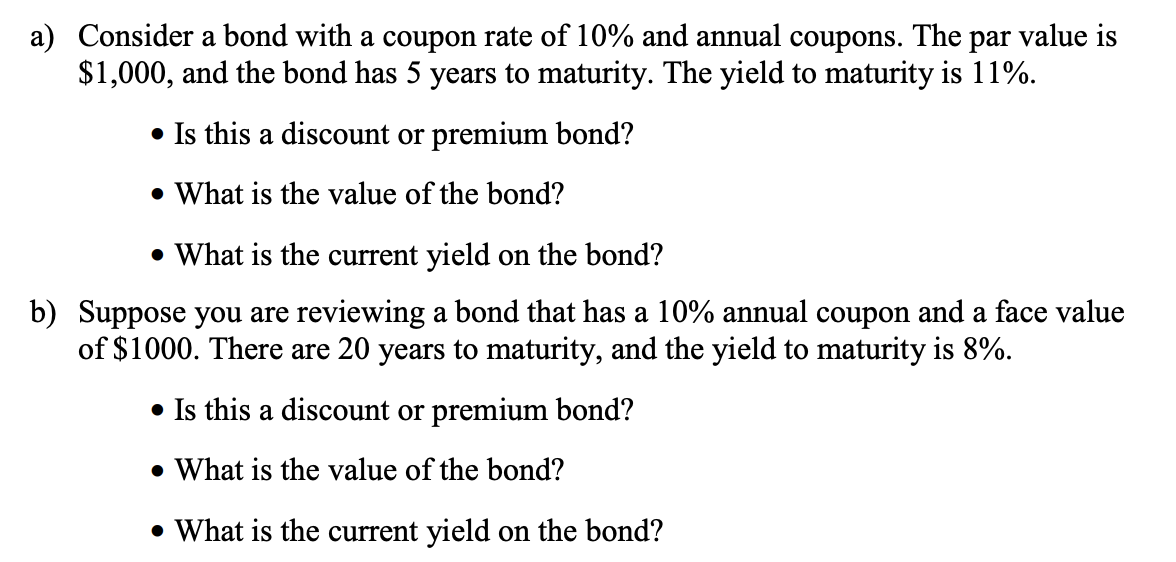

Solved a) Consider a bond with a coupon rate of 10% and

Tutorial 6 - Solution - Compound Interest Bond prices and yields Corporate Bonds No Arbitrage in - Studocu

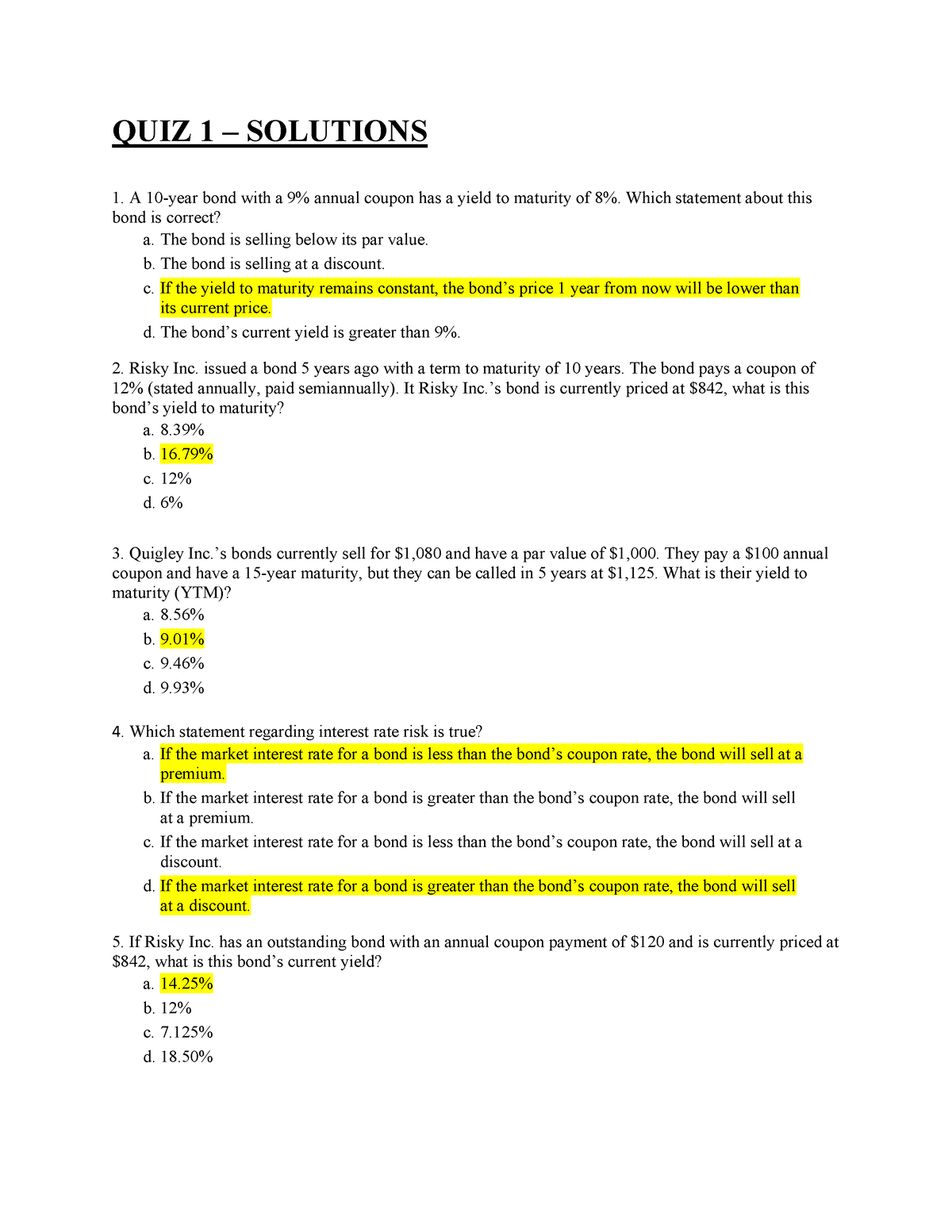

QUIZ 1 - Solutions iaf620 - QUIZ 1 – SOLUTIONS A 10-year bond with a 9% annual coupon has a yield to - Studocu

Bond Yields: Nominal and Current Yield, Yield to Maturity (YTM) with Formulas and Examples

Solved] A 20-year, 8% semiannual coupon bond with a par value of $1000 may

A bond has a coupon of 6.5% and it pays interest semiannually. With a face value of $1000, it will mature after 10 years. If you require a return of 12% from