Negative Correlation - FundsNet

What is Negative Correlation? Negative correlation is a relationship between two variables where the variables have an inverse relationship. Basically, with negative correlation, as one variable increases, the other variable decreases. Negative correlation is often described by a correlation coefficient that is between 0 and -1. Two variables with a perfectly negative correlation would have View Article

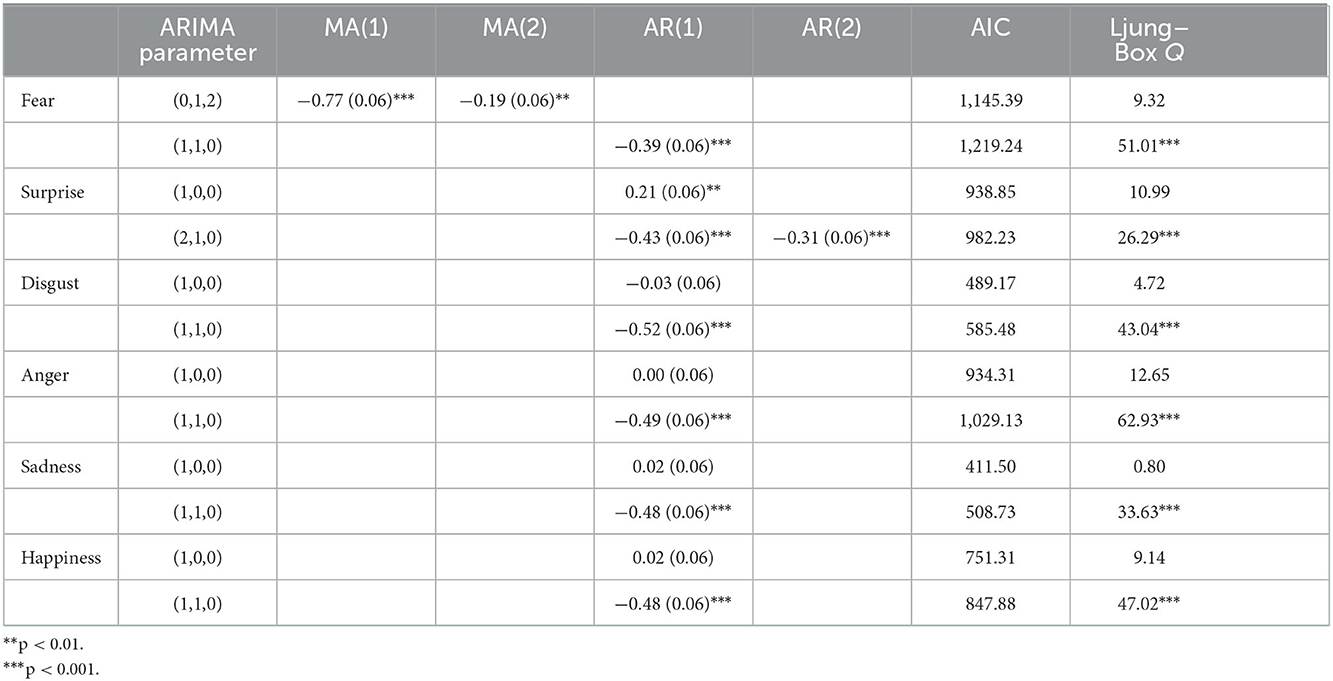

Frontiers Forecasting fund-related textual emotion trends on

U.S. Equity Mutual Funds: Net New Cash Flows (In billions of US

Domestic and Foreign Mutual Funds in Mexico in: IMF Working Papers

How to predict market tops and bottoms using the COT report.

Theme Library Search - Japan

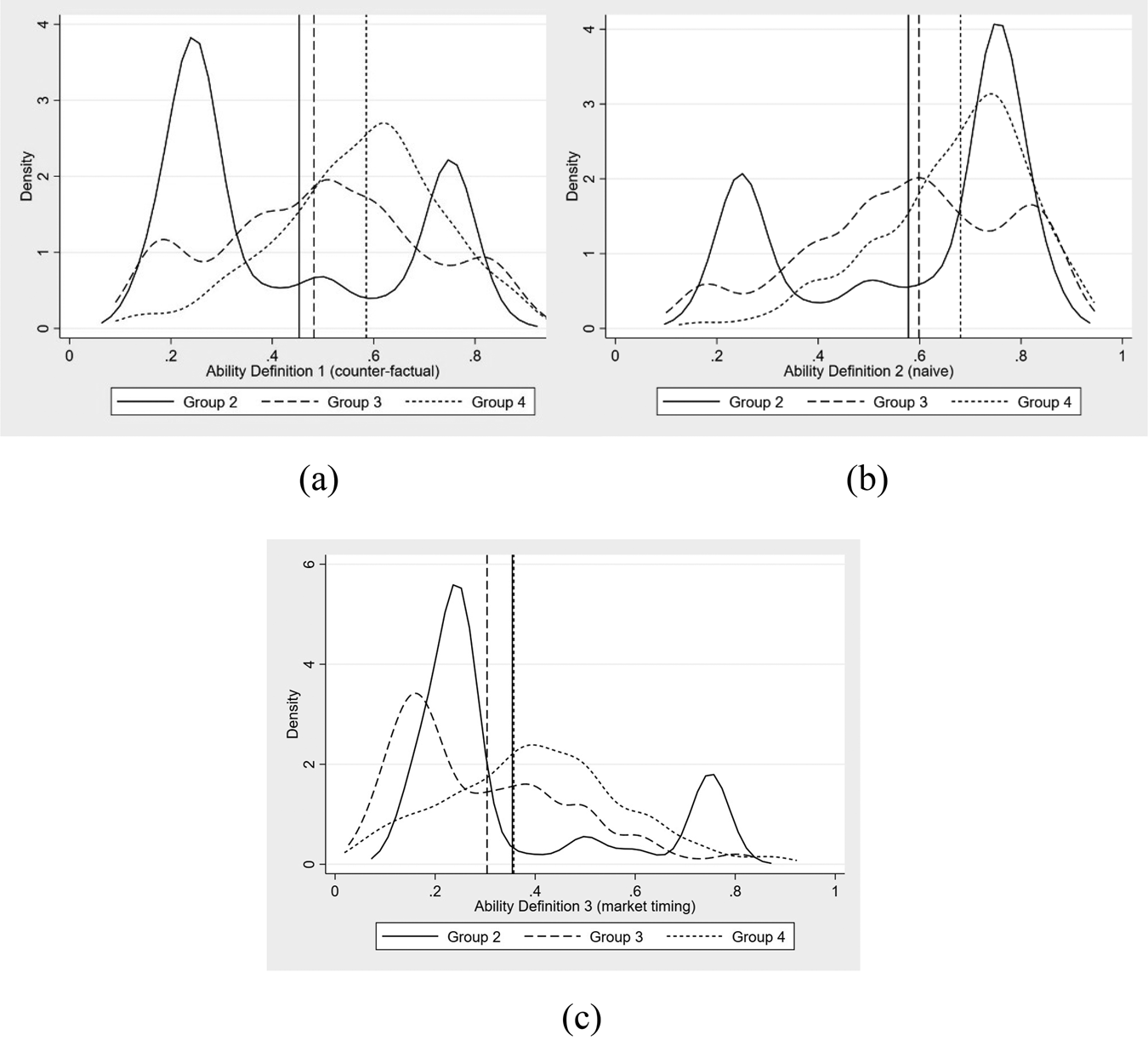

Mislearning and (poor) performance of individual investors

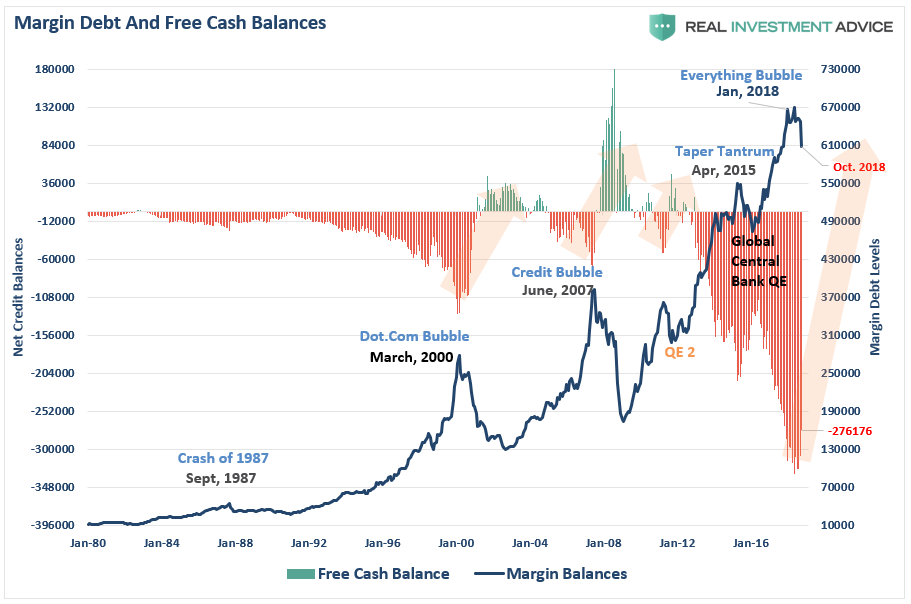

Misdiagnosing The Risk Of Margin Debt

U.S. Equity Mutual Funds: Net New Cash Flows (In billions of US

Monthly Credit Outlook: February 2023 Monthly Credit Outlook

Negative Correlation - FundsNet

New Zealand: Staff Report for the 2015 Article IV Consultation in

U.S. Equity Mutual Funds: Net New Cash Flows (In billions of US

The performance of household-held mutual funds: Evidence from the