Low-Income Housing Tax Credit Could Do More to Expand Opportunity

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

Incentivizing Developers To Reuse Low Income Housing Tax Credits - Federation of American Scientists

The Effects of the Low-Income Housing Tax Credit (LIHTC) – NYU Furman Center

The Low Income Housing Tax Credit - PRRAC — Connecting Research to Advocacy

Building the Case: Low-Income Housing Tax Credits and Health

Low-Income Housing Tax Credit (LIHTC): Details & Analysis

How the Federal Tax Code Can Better Advance Racial Equity

Low-Income Housing Tax Credit: Opportunities to Improve Oversight

2023 State of the Nation's Housing report: 4 key takeaways

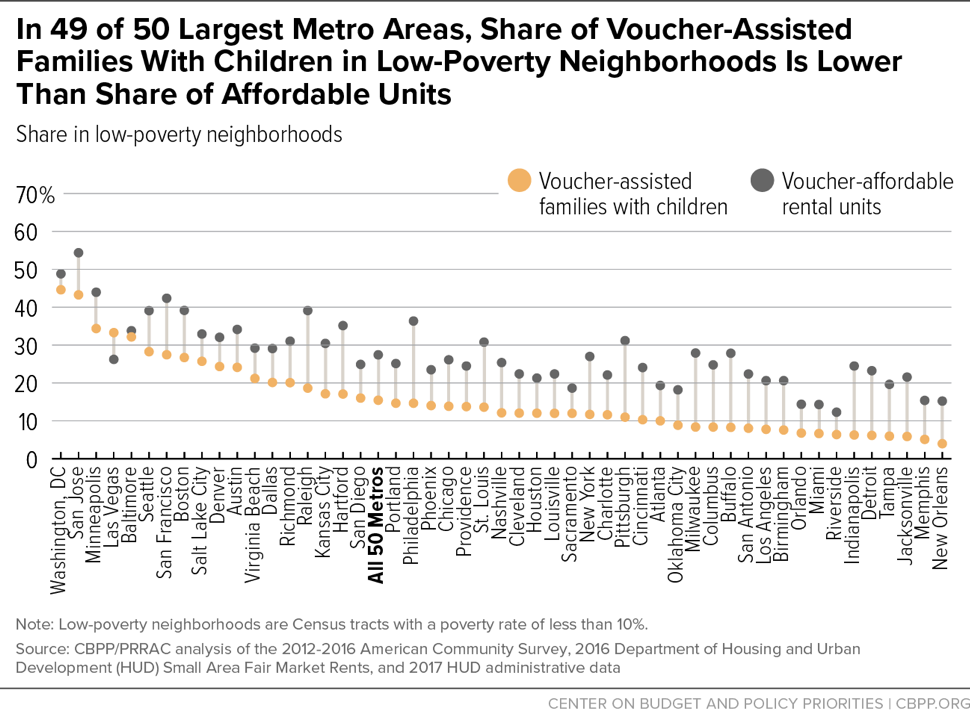

Where Families With Children Use Housing Vouchers

Washington State Housing Finance Commission

Few Low-Income Housing Tax Credit Units Are in Low-Poverty Neighborhoods