Australian Government Bonds - Bond Adviser

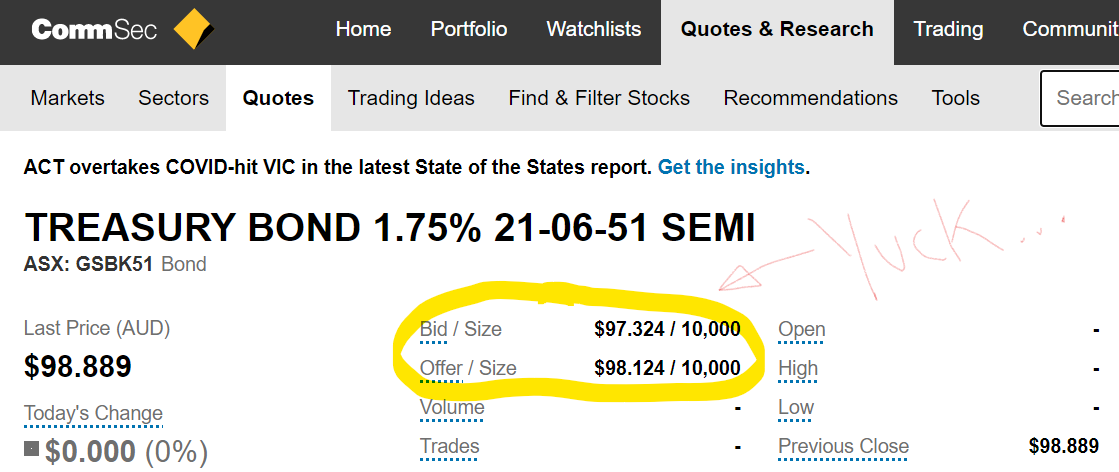

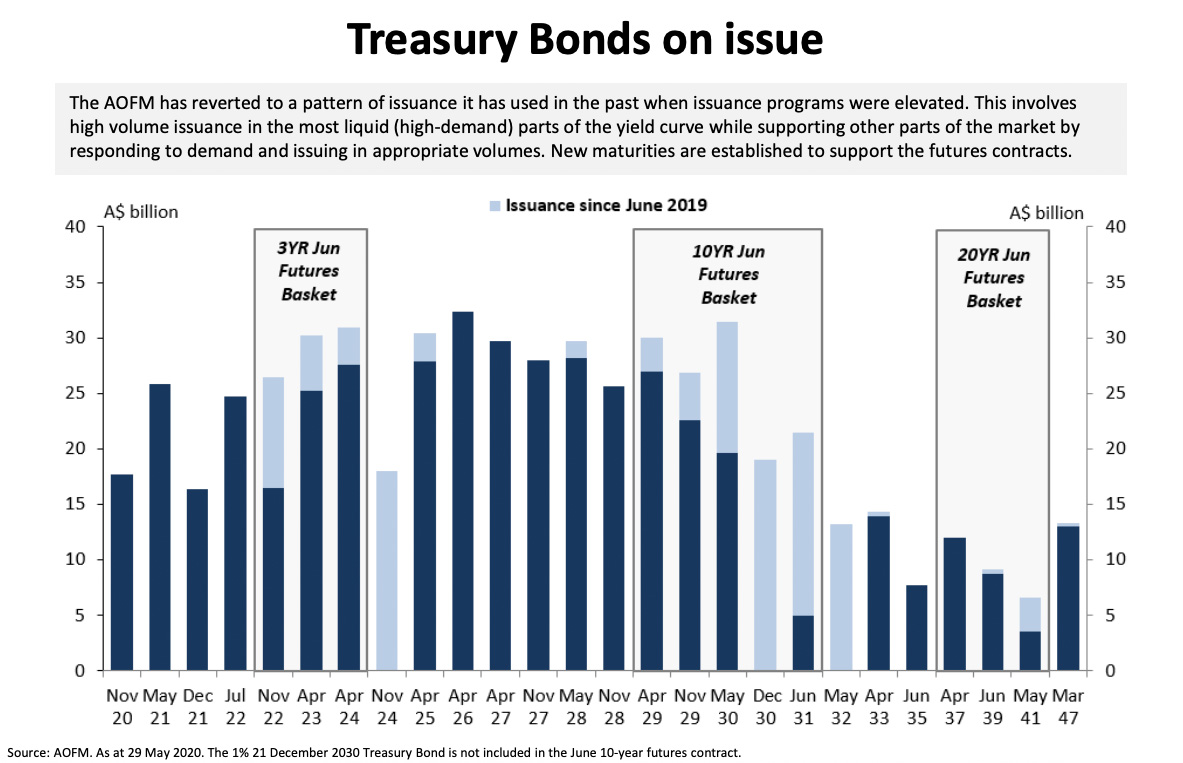

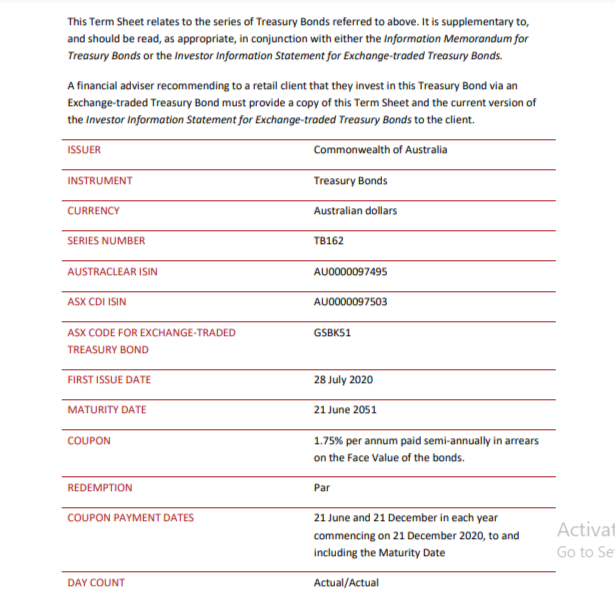

Commonwealth Government Bonds (CGS) are medium to long term debt issued by the Treasury through the Australian Office of Financial Management (AOFM). These securities pay a fixed coupon semi-annual in arrears, which are redeemable at face value on the specified maturity date and are the most liquid fixed income security in the Australian. Bonds issued

/content/gsam/gbr/en/advisors/resource

:max_bytes(150000):strip_icc()/dotdash-INV-final-Bond-Spreads-A-Leading-Indicator-For-Forex-Apr-2021-01-5f06416c041d49c083116bd4d3d61cf2.jpg)

Bond Spreads: A Leading Indicator For Forex

How to Invest in Treasury Bonds

Treasury Bonds, SmartAsset

Bonds

Bond Basics: How Interest Rates Affect Bond Yields

Understanding How Foreign Bonds Work - SmartAsset

The best Australian government bond ETF: BlackRock's IGB vs Vanguard's VGB vs BetaShares' AGVT

BondAdviser

How Much Will the New 30-year Government Bond Pay? - Fixed Income News Australia

How ETF bond ladders can help give client portfolios a boost

This Term Sheet relates to the series of Treasury

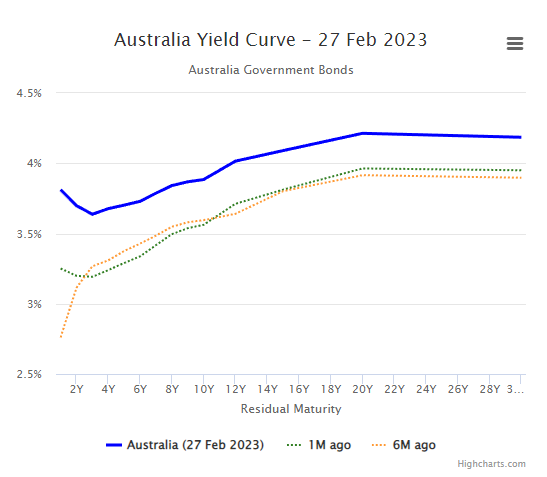

ABSI - The Australian Yield Curve and its importance for all Investors

/wp-content/uploads/2023/07/30-Year

Home Page australiangovernmentbonds