Are HOAs Considered Non-Profit Organizations?

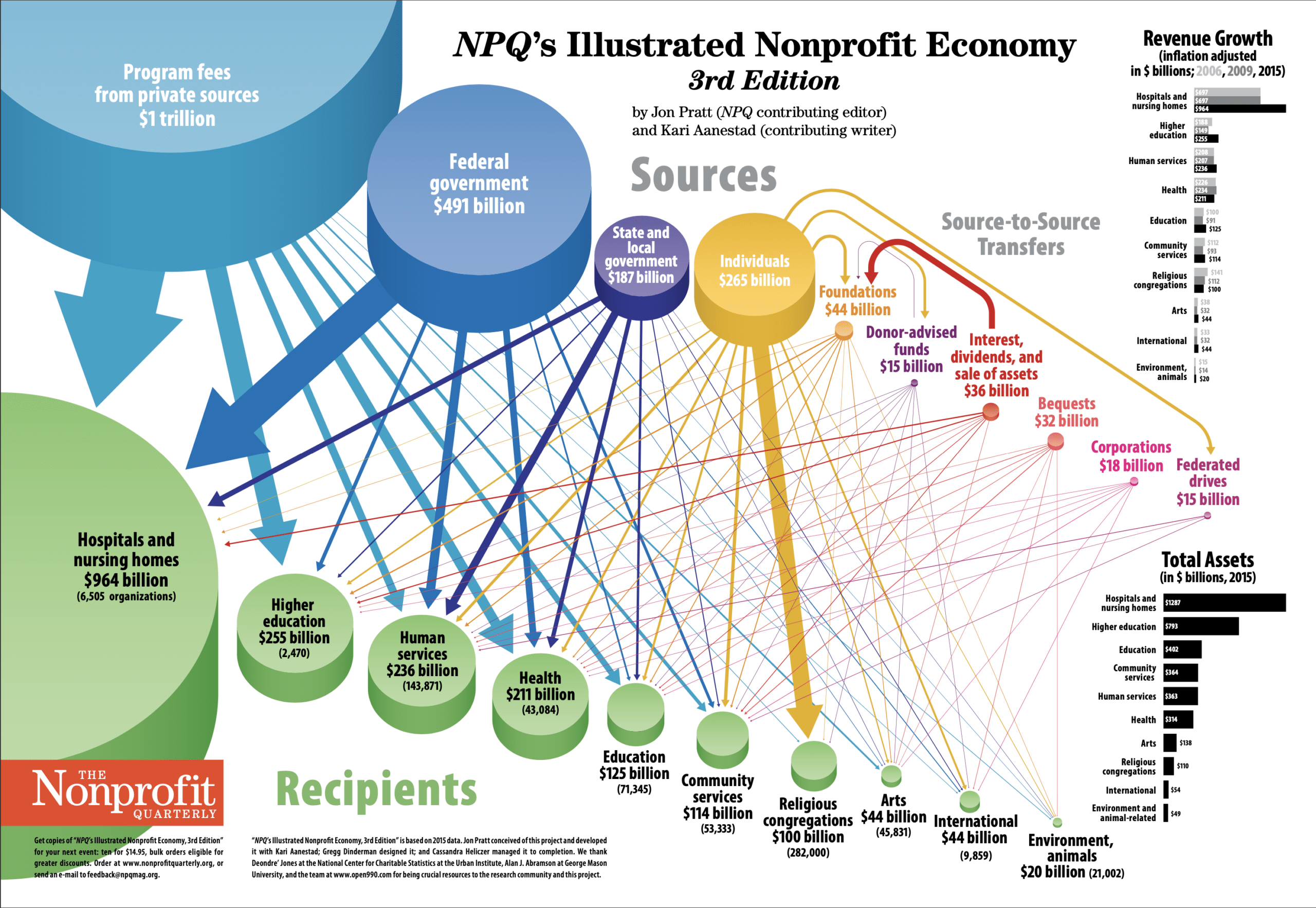

Homeowners’ associations are often organized as non-profits. By incorporating non-profit status into the bylaws of the community, the association is always registered as a non-profit. So, how does the IRS treat an HOA? Are homeowners’ associations corporations? Do HOAs have to file tax returns and pay taxes? These are very common questions and ones that

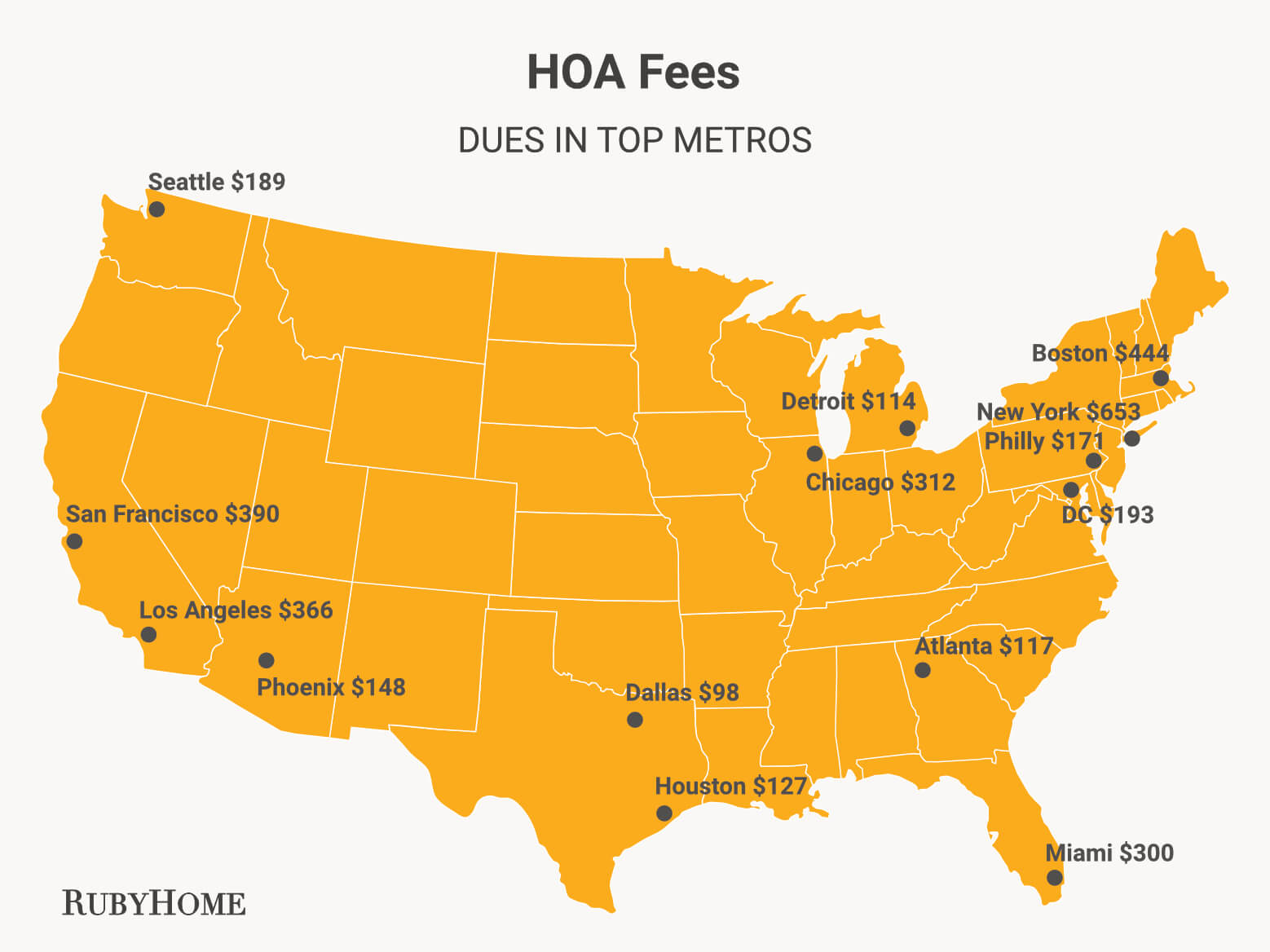

HOA Stats: Average HOA Fees & Number of HOAs by State (2024)

HOA's: All About Homeowner Associations, Tips & Advice, Jump Realty Inc, Real Estate Windsor-Essex County

What's the difference between a Homeowners Association vs Property Owner's Association? - Home Outlet

Fuck them HOA fees : r/BlackPeopleTwitter

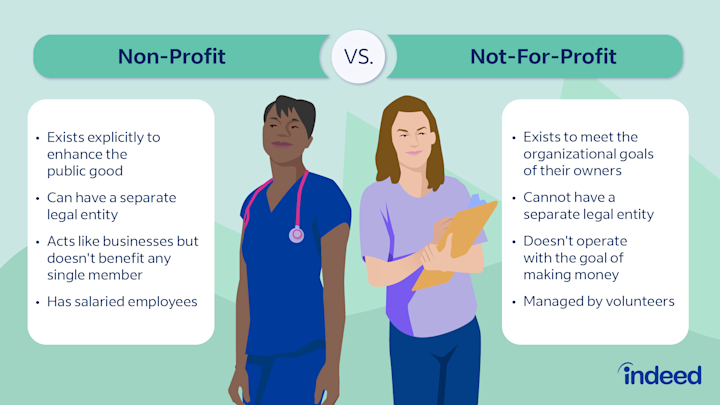

For-Profit vs. Non-Profit Organizations: Key Differences

Form 1120-H Instructions: Tips & Tricks to Stay Out of Trouble »

Are HOAs Considered Non-Profit Organizations?

What Are HOA Fees And What Do They Cover?

HOA Association Management Software

What are articles of incorporation for HOA?

50+ HOA Statistics: Average HOA Fees & Number of HOAs by State

Minnesota HOA and Condo Association Tax Return: Step by Step Process »

9 Common HOA Violations And How To Avoid Them

HOA Management Companies: What Do They Do and Does Your HOA Need One?